Does the Princeton Everest Fund Deserve an Allocation in Your Portfolio?

We think investors should consider expanding beyond the traditional equity and fixed-income investment to meet long-term return goals.

Potential benefits of investing:

-

Adds return diversification of asset classes

-

Potential to lessen overall risk during market downturns

-

May exhibit lower volatility than public equities1

-

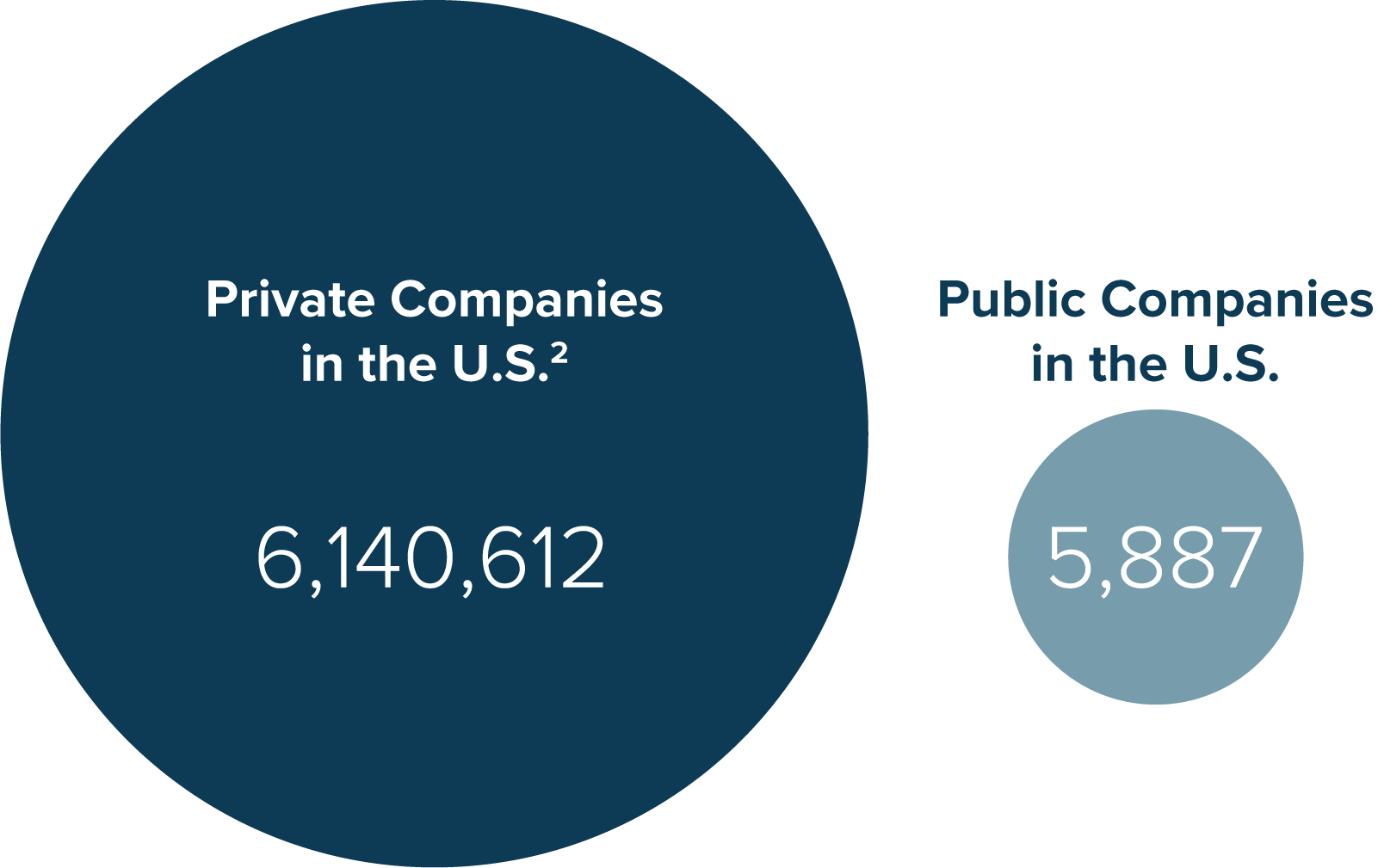

The universe of private companies versus public companies is vastly larger2

Investors should determine if the Princeton Everest Fund is right for their portfolio.

Potential drawbacks of investing:

-

Investor accreditation standard is required to invest

-

Limited liquidity compared to public traded equities

-

Higher fees and minimum investments versus traditional asset classes

-

An investment in the Fund is speculative, involves significant risk and is not suitable for all investors. It is possible that you may lose some or all of your investment

- Standard deviation of Class I: 6.77%, S&P 500: 16.22%, MSCI ACWI: 15.59%. Data from 6/1/16 – 12/31/23. Standard deviation is a statistical measure of an asset as it falls and rises from its average price. A low standard deviation indicates a narrow trading range and historically less volatility.

- World Federation of Exchanges database as of June 2023. US Census Bureau as of 2022, the most recently available data as of 9/15/2023.

Universe of Private Companies are Vastly Larger

-

i. The number of U.S. public companies has been steadily declining from 8,090 in 1998 down to 5,887 in 20231

-

A large universe of private companies in the U.S. may represent significant opportunity for private equity managers

- World Federation of Exchanges database as of June 2023.

- US Census Bureau as of 2022, the most recently available data as of 9/15/2023.