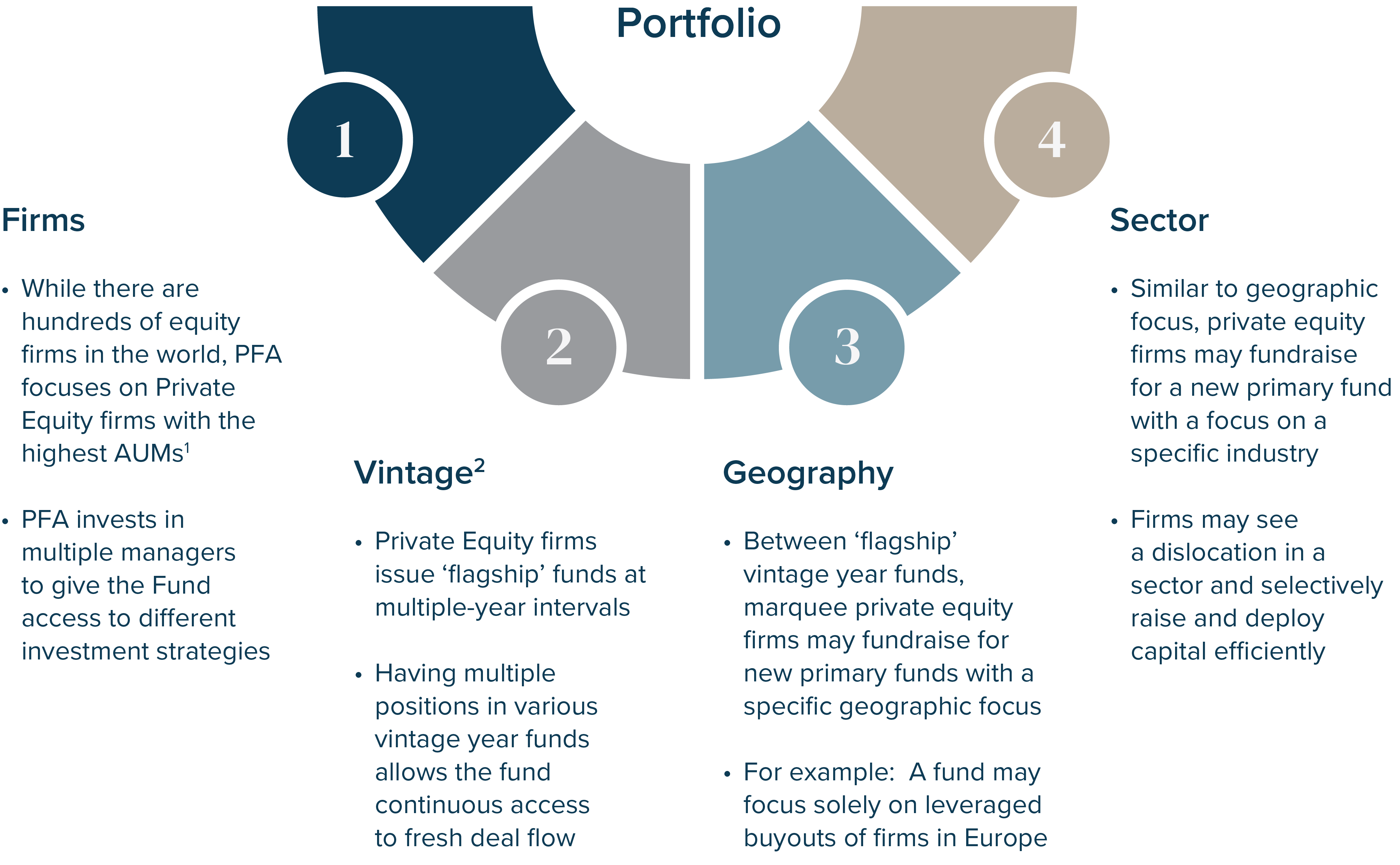

The Fund Seeks to Add Value Through Diversification

-

Source: Pitch Book 2023, Private Equity/Buyout Firms in USA by AUM

-

Vintage - The year in which a fund is formed and/or the year its first takedown of investment capital is committed. Having a vintage year for a fund is useful

Access to the Largest Managers in Private Equity

|

Manager (9 as of 12/31/2023) |

PE Funds Invested (20 Funds as of 12/31/2023) | Style | Experience | Vintages |

|---|---|---|---|---|

| Apollo Hybrid Value Fund, Apollo Fund X* | Special Situations Equity & Debt Investments, Buyout & Controlling Interest | Founded: 1990 AUM: $651B | 2018, 2022 |

| Bain Capital | Bain Capital Special Situations Asia | Special Situations Equity & Debt Investments | Founded: 1984 AUM: $180B | 2018 |

| Blackstone | Blackstone Capital Partners VIII, Blackstone Capital Partners IX* | Buyout and Controlling Interest | Founded: 1985 AUM: $1.04T | 2020, 2022 |

| Carlyle | Carlyle Direct Alternative Opportunities Fund II, Carlyle Partners VIII | Buyout and Controlling Interest | Founded: 1987 AUM: $382B | 2021 |

| Hellman & Friedman | Hellman & Friedman Fund XI* | Buyout and Controlling Interest | Founded: 1984 AUM: $92B | 2022 |

| North America Fund XI, XII, XIII, European Fund V, Asian Fund III | Buyout and Controlling Interest | Founded: 1976 AUM: $553B | 2012, 2017, 2018, 2021 |

| Silver Lake | Silver Lake Alpine Partners II, Silver Lake Partners VII* | Non-Controlling Equity Investments, Buyout & Controlling Interest | Founded: 1999 AUM: $101B | 2021, 2022 |

| Warburg Pincus Global Growth, Warburg Pincus Global Growth 14 | Buyout and Controlling Interest | Founded: 1966 AUM: $84B | 2018 |

| TPG Partners VIII, TPG Health Care Partners, TPG Partners IX* | Buyout and Controlling Interest | Founded: 1992 AUM: $222B | 2018, 2022 |

Click here to view Fund Holdings

AUM refers to Assets Under Management of each Private Equity Firm. This document does not constitute an offer to sell or a solicitation of an offer to buy securities of the private equity firms presented here.

* Denotes that PEF has been accepted into the Private Equity Fund by 12/31/2023. The underlying fund has not called capital yet.

1 Vintage refers to the milestone year in which the first influx of investment capital is delivered to a project or company.

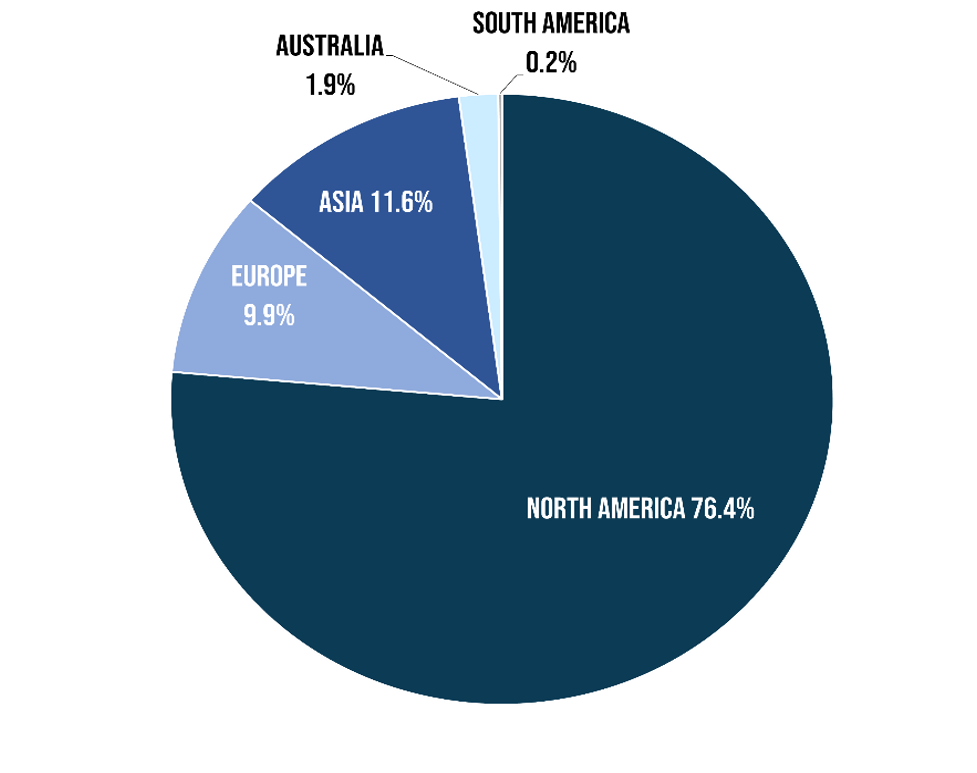

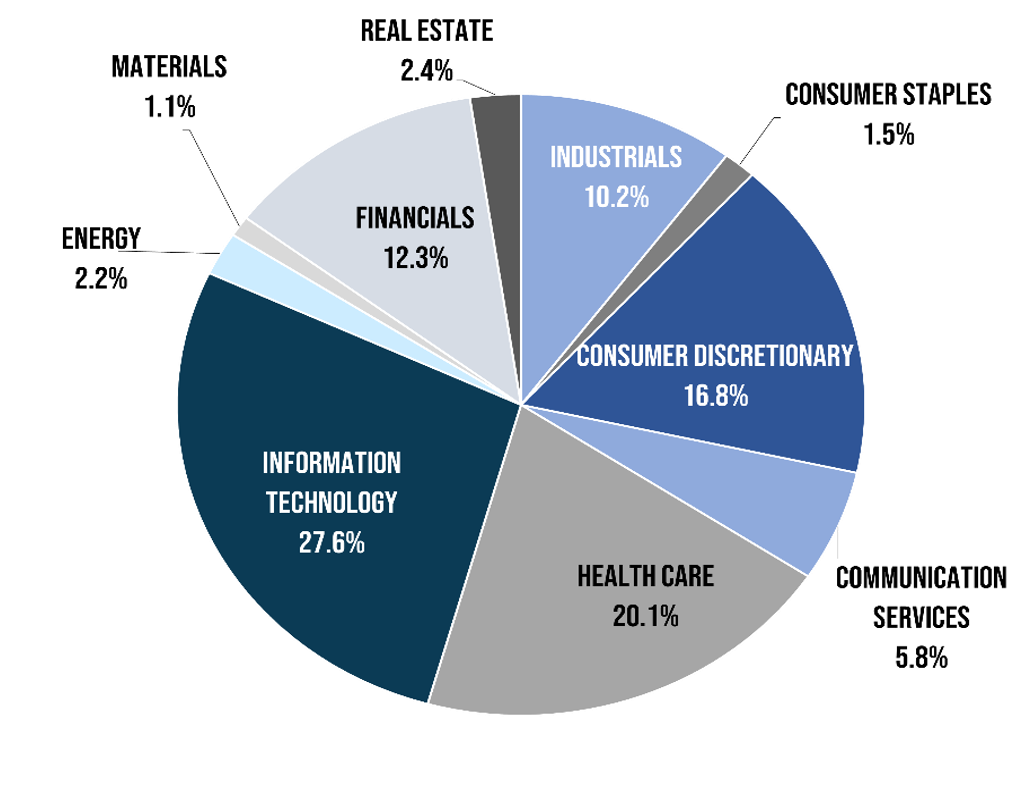

Diversified Fund Selection

The Fund selection is diversified across more than 350 portfolio companies and

investments from a variety of sectors and geographic locations

As of 12/31/2023

Data as of 12/31/2023, the most recently available data. Global stocks represented by MSCI All-Country World Index. Domestic stocks represented by Standard and Poor’s 500 index. Fixed Income represented by Bloomberg Barclays Aggregate Index. Private Equity is represented by Cambridge U.S. Private Equity Index. There is no assurance these opinions or forecasts will come to pass. Past performance is no guarantee of future results.